Gift card analytics play a critical role in helping businesses understand customer behavior, optimize operations, and drive long-term revenue growth. Every transaction contains valuable signals, from purchase timing to redemption behavior, that can be transformed into actionable business intelligence.

In this article, we explore how data-driven insights helped improve performance, identify growth opportunities, and scale digital gift card operations efficiently.

Understanding Gift Card Data and Customer Behavior

Gift card transactions tell two stories. One belongs to the buyer, often an existing customer introducing the brand to someone else. The second belongs to the redeemer, who is frequently a first-time customer. By leveraging gift card analytics, businesses can understand how customers discover brands and how gifting influences engagement and conversion.

Why Transaction-Level Insights Drive Business Growth

Sales numbers alone do not reveal the full picture. Behavioral data shows how customers interact with gift cards after purchase, including when they redeem and how much they spend. Using gift card analytics, businesses can identify which products perform best, which regions show higher redemption rates, and how gifting impacts customer lifetime value.

Industry research published by Forbes highlights that gift card users frequently spend more than the card’s original value, increasing total transaction revenue and profit margins.

Source: https://www.forbes.com

Key Performance Metrics in Gift Card Programs

Spending Patterns and Average Order Value

One of the most important insights comes from tracking overspending trends. Customers often add extra items beyond the gift card balance, which increases average order value. Monitoring this behavior through gift card analytics helps businesses refine pricing strategies and promotional offers.

Redemption Speed and Revenue Forecasting

Redemption speed varies between digital and physical cards. Digital gift cards are typically redeemed faster, enabling more accurate cash flow forecasting. Applying gift card analytics to redemption cycles helps businesses plan inventory and manage liquidity more effectively.

Seasonal Demand Trends in Digital Gift Cards

Gift card demand follows clear seasonal patterns, especially during holidays and major gifting periods. Businesses that rely on gift card analytics can anticipate these demand spikes and align marketing campaigns accordingly, improving conversion rates and reducing missed sales opportunities.

Historical data allows teams to plan promotions in advance instead of reacting to demand after it peaks.

Turning Data Insights Into Action With WUPEX

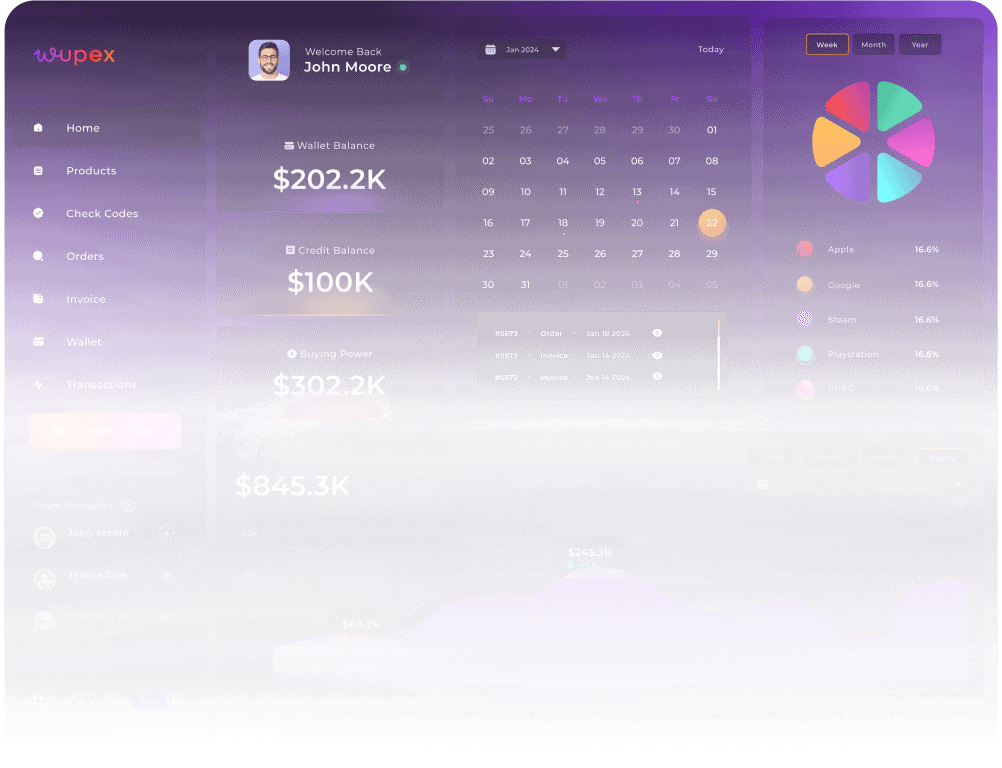

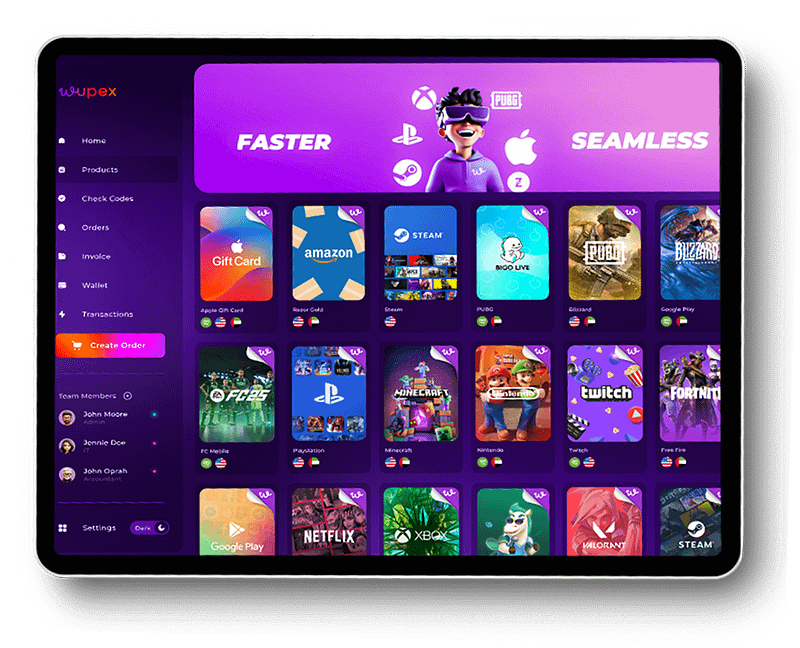

To unlock the full value of transaction data, analytics must be integrated across systems. Connecting gift card platforms with CRM, reporting, and loyalty tools creates a unified customer view.

This is where WUPEX delivers value. The WUPEX Gift Card API enables real-time transaction tracking, scalable distribution, and enterprise-level reporting for banks, fintechs, retailers, and resellers.

Learn more here: https://wupex.com/gift-card-api

By applying gift card analytics at scale, partners can improve transparency, reduce operational risk, and make faster, data-backed decisions.

How Data-Driven Reporting Helped Double Sales

By consistently analyzing customer behavior, redemption patterns, and spending trends, businesses can transform gift cards into strategic growth tools. When gift card analytics are used across marketing, operations, and partner reporting, the result is higher order values, stronger customer acquisition, and predictable revenue growth.

Conclusion

Gift card programs generate more than revenue. They generate insight. When businesses treat transaction data as a strategic asset, they unlock opportunities for smarter growth and stronger customer relationships.

With the right infrastructure and gift card analytics, platforms like WUPEX empower partners to scale globally, operate efficiently, and compete in an increasingly data-driven digital economy.